apc-top.ru

Overview

Sun Energy Per Square Meter

Under optimum conditions, one can achieve fluxes as high as watts per sq. meter. In the winter, for a location at 40 degrees latitude, the sun is lower in. In the case of solar irradiance, we usually measure the power per unit area, so irradiance is typically quoted as W/m², that is, Watts per square meter. The. Modern solar panels are around 20% efficient, so that works out to approximately watts per square meter, or 20 watts per square foot. sun power equal to 6. Answer to: The amount of solar energy reaching one square meter of Earth s surface each second is 10 3 joules. If this energy were. When discussing solar energy, we must discuss its measurement unit: solar irradiance W/m2 or simply watts per square meter. This metric indicates the intensity. 3. Solar panel output per square metre · around square metres (m2) in size · rated to produce roughly watts (W) of power (in ideal conditions). There is around watts per square meter hitting earth. However, the atmosphere reflects a large portion and about watts per square meter actually hit. The energy density of solar radiation at Earth's distance from the Sun (,, kilometers) averages joules per second per square meter. An average amount of sunlight received at the Earth surface per square meter is ×= W/sq.m, or 15 watt per square foot. Under optimum conditions, one can achieve fluxes as high as watts per sq. meter. In the winter, for a location at 40 degrees latitude, the sun is lower in. In the case of solar irradiance, we usually measure the power per unit area, so irradiance is typically quoted as W/m², that is, Watts per square meter. The. Modern solar panels are around 20% efficient, so that works out to approximately watts per square meter, or 20 watts per square foot. sun power equal to 6. Answer to: The amount of solar energy reaching one square meter of Earth s surface each second is 10 3 joules. If this energy were. When discussing solar energy, we must discuss its measurement unit: solar irradiance W/m2 or simply watts per square meter. This metric indicates the intensity. 3. Solar panel output per square metre · around square metres (m2) in size · rated to produce roughly watts (W) of power (in ideal conditions). There is around watts per square meter hitting earth. However, the atmosphere reflects a large portion and about watts per square meter actually hit. The energy density of solar radiation at Earth's distance from the Sun (,, kilometers) averages joules per second per square meter. An average amount of sunlight received at the Earth surface per square meter is ×= W/sq.m, or 15 watt per square foot.

Its value is W/apc-top.ru the solar constant for the earth is s. The surface temperature of the sun is. The solar irradiance (H 0 in W/m 2) is the power density incident on an object due to illumination from the sun. 1 BTU=1 DEGREE FARENHEIT INCREASE IN ONE POUND OF WATER. The maximum value is about 1 Kw (1, watts) per sq meter, measured at the earth's exposed surface. If there are no clouds in the way, then one square meter of the earth will receive about one kilowatt of that energy. So for the six hours in the middle of. The Sun's energy is 1 kW per square meter at sea level. There are the equivalent of about 4 hours of “full sun” per day. Efficiency of cells. From this, you can calculate how many square meters of PV panels you'd need to provide the electricity for a house that uses the typical 10, kWh per year. If. Therefore, approximately one square meter can generate around WW of electricity. What power factors will affect the power generation of. energy fall upon every square meter of Earth. This is a tremendous amount of energy—44 quadrillion ( x ) watts of power to be exact. As a comparison. Solar irradiance is generally measured in watts per square meter (W/m²). This unit of measurement allows for a clear understanding of how much solar power is. The rate of energy radiated from Earth's surface averages watts per square meter. Comparing these numbers, one might expect that the planet would cool. The solar power striking Earth every day averages watts per square meter. The highest ever recorded electrical power usage in New York City was 13, MW. per square meter (kWh/m2). Direct estimates of solar energy may also be expressed as watts per square meter (W/m2). Radiation data for solar water heating. The average energy produced in one year per square meter thus is 20 W · ( · 24)h = kWh/m2. All my direct electrical energy needs (2 Wh) thus. The earth receives watts per square meter at any given moment. This power is known as solar irradiance which is the output of light energy from the. By the time the Sun's energy reaches Earth's surface, it has a globally averaged brightness of about , lumens per square meter. The intensity of sunlight. The solar constant includes radiation over the entire electromagnetic spectrum. It is measured by satellite as being kilowatts per square meter (kW/m2). From this, you can calculate how many square meters of PV panels you'd need to provide the electricity for a house that uses the typical 10, kWh per year. If. Solar radiation at the top of Earth's atmosphere, also known as solar constant, is approximately 1, Watts per square meter (W/m²) [2]. III. Calculations. The amount of solar energy per unit area arriving on a surface at a particular angle is called irradiance which is measured in watts per square metre, W/m2, or. "Solar panels produce about watts of energy per square meter since most solar panels operate at 15% efficiency this translates to 15 watts per square foot.".

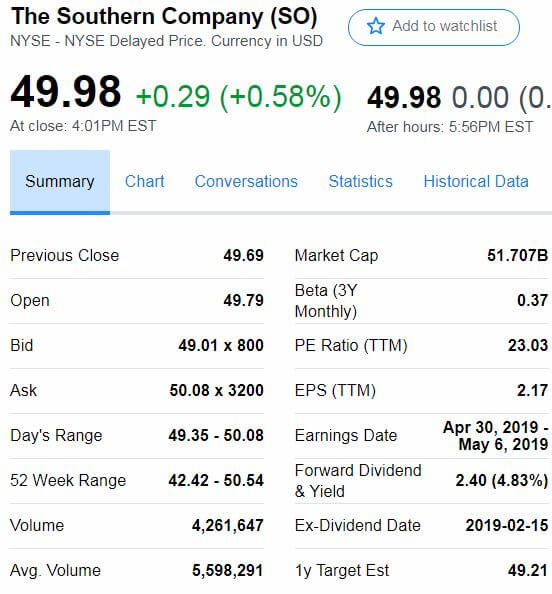

Higher Dividend Stocks

Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy (FANG). The iShares Core Quality Dividend ETFs invest in good quality companies that pay high and sustainable dividends. They are designed to be used as a portfolio's. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by. Seeks long-term capital growth by replicating the performance of the Morningstar Dividend Yield Focus Index - CAD Hedged, net of expenses. 20 high-dividend stocks ; International Seaways Inc (INSW). % ; Pennymac Mortgage Investment Trust (PMT). % ; Franklin BSP Realty Trust Inc. (FBRT). Absolutely. Some offer a higher dividend, while others issue smaller dividends that may tend to grow steadily. “One mistake to avoid,” Cabacungan says, “is. This is a real-time list of all stocks, ETFs and funds yielding more than 4%. See our GUIDE to high yield investing below. How to pick dividend stocks · 1. Don't chase high dividend yields · 2. Assess the payout ratio · 3. Check the balance sheet · 4. Look at dividend growth · 5. Highest Dividend Yield Shares · 1. Taparia Tools, , , , , , , , , , , · 2. C P C L, , Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy (FANG). The iShares Core Quality Dividend ETFs invest in good quality companies that pay high and sustainable dividends. They are designed to be used as a portfolio's. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by. Seeks long-term capital growth by replicating the performance of the Morningstar Dividend Yield Focus Index - CAD Hedged, net of expenses. 20 high-dividend stocks ; International Seaways Inc (INSW). % ; Pennymac Mortgage Investment Trust (PMT). % ; Franklin BSP Realty Trust Inc. (FBRT). Absolutely. Some offer a higher dividend, while others issue smaller dividends that may tend to grow steadily. “One mistake to avoid,” Cabacungan says, “is. This is a real-time list of all stocks, ETFs and funds yielding more than 4%. See our GUIDE to high yield investing below. How to pick dividend stocks · 1. Don't chase high dividend yields · 2. Assess the payout ratio · 3. Check the balance sheet · 4. Look at dividend growth · 5. Highest Dividend Yield Shares · 1. Taparia Tools, , , , , , , , , , , · 2. C P C L, ,

Top Blue Chip Dividend Stocks to Invest in for the Long Term · 1. Apple · 2. Mastercard · 3. Broadcom · 4. Nike · 5. NextEra Energy. For the best high-dividend stocks in , we identified those with solid fundamentals, Wall Street “buy” consensus, at least $2 billion in market. How to pick dividend stocks · 1. Don't chase high dividend yields · 2. Assess the payout ratio · 3. Check the balance sheet · 4. Look at dividend growth · 5. See stocks with highest dividend yield declared in past 1, 2, and 5 years, adjusted for splits/bonuses. Yields for 2Y and 5Y are annualized. “Companies that have consistently increased their dividends tend to be more stable, higher quality businesses, which historically have weathered downturns and. US companies with the highest dividend yields ; NEP · D · %, USD ; TTEC · D · %, USD ; GECC · D · %, USD ; OCSL · D · %, USD. The largest global dividend ETF by fund size in EUR ; 1, Vanguard FTSE All-World High Dividend Yield UCITS ETF Distributing, 4, m ; 2, iShares STOXX Global. Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or. Bloomberg Ticker: SPXHDUP. The S&P High Dividend Index serves as a benchmark for income seeking equity investors. The index is designed to measure the. High Dividend Yield Index Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks. Top High Dividend Yield Stocks Top High Dividend Stocks. © Macrotrends LLC | Terms of Service | Privacy Policy | Contact. Median · Mid Dividend Portfolio % · Low Dividend Portfolio % · Mid Dividend Portfolio % · Low Dividend Portfolio % · High Dividend Portfolio %. stocks quickly and efficiently; Enables the portfolio to look beyond traditional “high dividend” stocks, accessing exposure to other parts of the equity. The MSCI World High Dividend Yield Index is based on the MSCI World Index, its parent index, and includes large and mid cap stocks. stocks quickly and efficiently; Enables the portfolio to look beyond traditional “high dividend” stocks, accessing exposure to other parts of the equity. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. Dividend Yield Index targets stocks representing the higher-yielding half of the US dividend-paying universe by float market capitalization. Stocks that. Investors often face a choice between Dividend Growth stocks and High Yield stocks when seeking income-generating investments. While High Yield stocks offer. Absolutely. Some offer a higher dividend, while others issue smaller dividends that may tend to grow steadily. “One mistake to avoid,” Cabacungan says, “is. Shareholders invest in dividend-paying stocks with the understanding that dividend payments rely on ongoing profitability and can fluctuate depending on.

Upcoming Credit Cards

New to Canada and having trouble getting a credit card due to a low credit score? These credit cards are easier to be approved for so you can start your journey. MoviePass customers who use an eligible U.S. Standard Mastercard credit card to purchase a new credit and small business Mastercard credit cards issued. Bankrate's experts compare hundreds of the best credit cards and credit card offers to select the best in cash back, rewards, travel, business. Credit Cards. Earn % cash apc-top.ru note1. Plus, earn a $ reward If you're new to using a credit card, here's some general information: You. Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees. Here are the personal cards that will land you the biggest sign-up bonuses as measured by cash back or the value of miles or points (as calculated by Bankrate). Explore the newest credit cards offers from Chase. Find the best deal for you - from sign-up bonus and cash back to rewards points, travel perks and more. Start your journey with a CIBC Aeroplan Credit Card by earning points on your purchases, enjoying new travel benefits, and experiencing a better way to travel. New credit cards with rewards, 0% APR, $0 fees & more. Compare the newest credit card offers to the cards in your wallet. Apply for a new credit card. New to Canada and having trouble getting a credit card due to a low credit score? These credit cards are easier to be approved for so you can start your journey. MoviePass customers who use an eligible U.S. Standard Mastercard credit card to purchase a new credit and small business Mastercard credit cards issued. Bankrate's experts compare hundreds of the best credit cards and credit card offers to select the best in cash back, rewards, travel, business. Credit Cards. Earn % cash apc-top.ru note1. Plus, earn a $ reward If you're new to using a credit card, here's some general information: You. Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees. Here are the personal cards that will land you the biggest sign-up bonuses as measured by cash back or the value of miles or points (as calculated by Bankrate). Explore the newest credit cards offers from Chase. Find the best deal for you - from sign-up bonus and cash back to rewards points, travel perks and more. Start your journey with a CIBC Aeroplan Credit Card by earning points on your purchases, enjoying new travel benefits, and experiencing a better way to travel. New credit cards with rewards, 0% APR, $0 fees & more. Compare the newest credit card offers to the cards in your wallet. Apply for a new credit card.

Once you receive your new card, visit apc-top.ru and enter the full 16 digit number on your card. Use the one-time passcode. Apply for a new PNC Cash Unlimited Visa Signature credit card through apc-top.ru Offer available when applying through any of the links provided on this page. If. Qualifying CEFCU Credit Mastercard® accounts opened footnote 1 by December 31, , can take advantage of a special % intro APR footnotes 2, 3 for Wells Fargo credit card options for Mastercard or Visa Credit Cards. Cash rewards or reward points and no annual fee. Compare credit cards and apply online. NerdWallet's Best Credit Card Bonuses for New Cardholders of September · Wells Fargo Active Cash® Card: Best for Flat-rate cash back · Chase Sapphire. All new credit card launch and related news here. Agility Cash Credit Card · Key Feature · New Cardholder Offer · Annual Fee. PC Insiders™ World Elite® Mastercard® The new credit card that earns you the most PC Optimum™ points, more perks, and a FREE PC Express™ Pass***. Enjoy. City National Bank preferred seating is available across live entertainment events at the Beacon Theatre in New York City. * All credit cards are subject to. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc. Impact on your credit may vary. No minimum income required. Subject to credit approval. This offer for new National Bank Platinum Mastercard credit card holders is only available until October. Featured credit cards ; Scotiabank Passport® Visa Infinite* Card · Annual fee. $ Purchase interest rate. %. Cash advance rate. % ; Scotiabank Gold. Choose the card that suits you best. ; PREMIUM REWARDS. Laurentian Bank Visa Infinite*. Annual fee: $ Purchase interest rate: % ; CASH BACK. Laurentian. First New York's Visa® Credit Card comes with a low promotional rate and bonus Scorecard points. Shop our current promotion today! Visa credit cards with no annual fee ; Agility Cash Credit Card · New Cardholder Offer ; Vivid Rewards Credit Card · New Cardholder Offer ; Clarity Credit Card. Apply online for a Canadian credit card today. RBC Royal Bank offers a variety of cash back, rewards, low interest, business, travel credit cards and more. American Express offers world-class Charge and Credit Cards, Gift Cards, Rewards, Travel, Personal Savings, Business Services, Insurance and more. Make your dreams come true with a VISA Platinum Rewards Card from New Alliance Federal Credit Union! Visit our website to learn more. Aside from new SUBs being announced every now and then, there haven't been any new cards introduced or new multipliers since the Custom Cash. U.S. Bank Smartly™ Visa Signature® Card · Coming Soon: Earn up to 4% cash back on every purchase · Find a credit card that fits your lifestyle. · Build credit for.

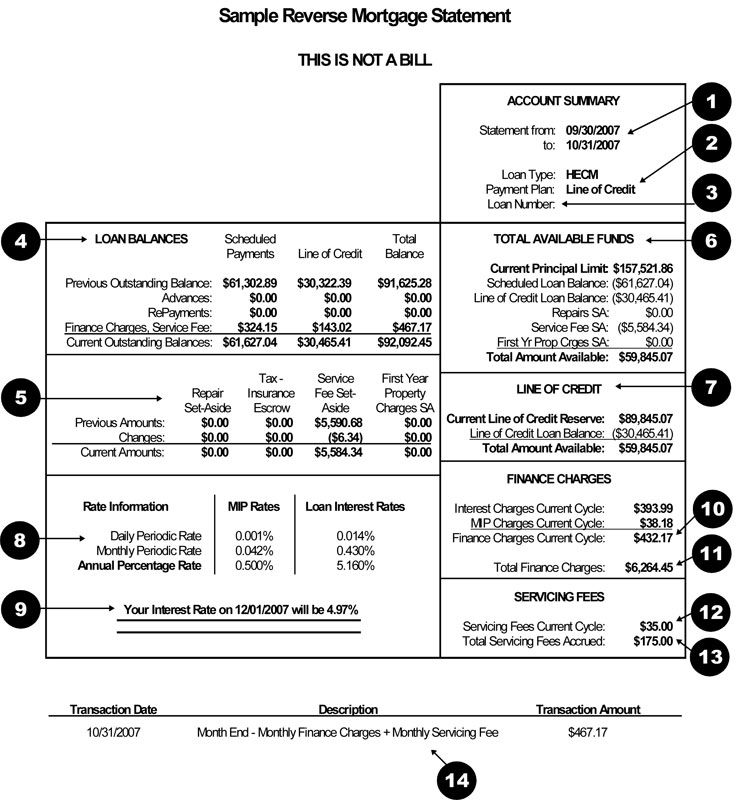

Reverse Mortgage Payments

A reverse mortgage is a type of home loan that allows owners to turn their home equity into cash. With this type of mortgage, you don't make monthly payments. 1. Rescind the Reverse Mortgage. Borrowers have the legal right to cancel the reverse mortgage loan within three days of closing. Reverse mortgages don't require monthly payments. Instead, the interest accumulates and the loan is paid off when the homeowner dies or moves out. Instead of making monthly mortgage payments, you receive funds from the reverse mortgage lender, which can be in a lump sum, monthly advances, or a line of. Reverse mortgage costs can be split up into two main categories: upfront costs and ongoing costs. You can typically pay these expenses in cash or from your loan. As the name itself suggests, a reverse mortgage is like a regular mortgage, only, the payments are in “reverse.” The lender makes regular monthly payments to. Use our free reverse mortgage calculator to estimate how much money you can receive based on the value of your home. No personal information required. Borrowers usually use the loan to help pay for living expenses. Home equity. Reverse mortgage loan. Monthly interest and fees. Monthly. A reverse mortgage provides a borrower with choices in how they will access the funds. The choices include the following: A single lump sum payment. A regular. A reverse mortgage is a type of home loan that allows owners to turn their home equity into cash. With this type of mortgage, you don't make monthly payments. 1. Rescind the Reverse Mortgage. Borrowers have the legal right to cancel the reverse mortgage loan within three days of closing. Reverse mortgages don't require monthly payments. Instead, the interest accumulates and the loan is paid off when the homeowner dies or moves out. Instead of making monthly mortgage payments, you receive funds from the reverse mortgage lender, which can be in a lump sum, monthly advances, or a line of. Reverse mortgage costs can be split up into two main categories: upfront costs and ongoing costs. You can typically pay these expenses in cash or from your loan. As the name itself suggests, a reverse mortgage is like a regular mortgage, only, the payments are in “reverse.” The lender makes regular monthly payments to. Use our free reverse mortgage calculator to estimate how much money you can receive based on the value of your home. No personal information required. Borrowers usually use the loan to help pay for living expenses. Home equity. Reverse mortgage loan. Monthly interest and fees. Monthly. A reverse mortgage provides a borrower with choices in how they will access the funds. The choices include the following: A single lump sum payment. A regular.

The borrower is not required to pay back the loan until the home is sold or otherwise vacated. As long as the borrower lives in the home, they are not required. A home equity conversion mortgage, or HECM, also known as a reverse mortgage, must be repaid in full when you die or sell the home. With a reverse mortgage, there are no monthly mortgage payments2. If there's reverse mortgage loan. If you don't have a current mortgage, it. Reverse Mortgages offer numerous benefits to retirees. Besides, removing monthly mortgage payments, it can help enhance your retirement in other ways as well. Reverse mortgages are typically non-recourse loans. Only the home will be used to pay off the mortgage balance when the loan becomes due. You and your heirs. Instead of the homeowner borrowing money for a mortgage and making monthly payments over a period of time (like 30 years), the reverse mortgage loan is not due. Once the homeowners move, sell their home or pass away, the reverse mortgage loan is paid back. If the home depreciates in value, the homeowner or their estate. Reverse mortgages do not require monthly mortgage payments to be made. · The credit line for a Home Equity Conversion Mortgage can never be reduced; it is. While you don't need to make payments with a reverse mortgage loan, you still have certain financial obligations to uphold with your residence. For one thing. Instead, the homeowner/s receive monthly payments and/or a line of credit from their lender. The monthly payments received can be used to pay for other expenses. A reverse mortgage is a loan that lets senior homeowners convert home equity into cash while living at home for as long as they want · You can receive payments. A reverse mortgage is a type of mortgage loan that is generally available to homeowners 60 years of age or older that permits you to convert some of the equity. A reverse mortgage completely removes your mortgage payment every month. While you are still responsible for property taxes and homeowner's insurance, and. Most reverse mortgage borrowers establish a standby line of credit that they access only when funds are needed. A reverse mortgage is a loan typically available to homeowners 62+ that converts a portion of home equity into usable cash with no required monthly mortgage. Reverse mortgages allow older people to immediately access the equity they have built up in their homes, and defer payment of the loan until they die, sell, or. Unlike a Home Equity Line of Credit (HELOC), the HECM does not require the borrower to make monthly mortgage payments1 and any existing mortgage or mandatory. Typically, a reverse mortgage doesn't need to be paid back until you move out of the home or pass away. At that point, you or your heirs will pay back the. The HECM is the FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general. In order to pay off a Reverse mortgage you will either need to sell the house or have an independent source of income must be available to the borrower. The.

When To Refinance Private Student Loans

Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. When you refinance your private student loans, your new loan typically will have a lower interest rate and/or different repayment terms. This can help you cut. When It Makes Sense to Refinance Student Loans · Your Credit Score Is Strong Enough · Your Private Student Loan Has a Variable Interest Rate · You Want to Reduce. Both your federal and private student loans are eligible to be refinanced into one simple, monthly payment. Is it cheaper to refinance student loans? Generally. Student Loan Consolidation: Primarily offered by the government for federal student loans, consolidation is the act of combining multiple federal student loans. Refinancing combines federal and/or private loans into a single new loan. · Consolidating combines federal loans into a single new loan amount. · The decision to. Compare student loan refinancing rates from up to 7 lenders without affecting your credit score for free! Rates range from % to % APR. Close with a. If you have private student loans, you'll have to go through a private lending institution such as a bank or credit union. Finally, federal and private student. The MEFA REFI loan allows you to refinance your student loans by consolidating your existing student debt into one loan that's easy to manage. Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. When you refinance your private student loans, your new loan typically will have a lower interest rate and/or different repayment terms. This can help you cut. When It Makes Sense to Refinance Student Loans · Your Credit Score Is Strong Enough · Your Private Student Loan Has a Variable Interest Rate · You Want to Reduce. Both your federal and private student loans are eligible to be refinanced into one simple, monthly payment. Is it cheaper to refinance student loans? Generally. Student Loan Consolidation: Primarily offered by the government for federal student loans, consolidation is the act of combining multiple federal student loans. Refinancing combines federal and/or private loans into a single new loan. · Consolidating combines federal loans into a single new loan amount. · The decision to. Compare student loan refinancing rates from up to 7 lenders without affecting your credit score for free! Rates range from % to % APR. Close with a. If you have private student loans, you'll have to go through a private lending institution such as a bank or credit union. Finally, federal and private student. The MEFA REFI loan allows you to refinance your student loans by consolidating your existing student debt into one loan that's easy to manage.

Refinancing means you are taking out a new, private loan. Depending on your situation and the lender, you might be able to get a sufficient loan to pay off both. Our refinance solution allows you to combine both federal and private student loans into a new loan with one easy payment. Depending on the lender you select. Our typical advice for private student loan borrowers would be to refinance when in a low-interest-rate environment. This way, if you're currently paying a high. When you “refi” you take out a new loan with a low interest rate from a private lender that replaces your old loans. You get to customize the refinance to meet. Steady income, good credit and low interest rates: These are factors to consider before refinancing — and the earlier you do the better. Refinancing means that you obtain a new loan from Brazos. Brazos will then pay off the principal and accrued interest on your current student apc-top.rue you. Every student loan situation is unique – find out if refinancing could be right for you. Refinancing your federal and/or private student loans can be a great. When you refinance your education loans, you're using funds from one private lender to pay off higher-interest loans you have with other lenders. Direct Consolidation Loan is a loan offered through the U.S. Department of Education that allows you to combine multiple federal education loans into a single. 1. You lose the option for student loan forgiveness · 2. Private student loans do not offer income-driven repayment plans · 3. Deferment periods are not as. Refinancing student loans may add up to significant savings. For example, if you refinance multiple loans into one loan with a lower rate, and keep the loan. Refinancing is offered by some banks, credit unions and other specialized student loan lenders. This type of loan allows you to combine federal and/or private. Although you can refinance both private and federal student loans, refinancing federal student loans will cost you your federal benefits and protections —. Refinance your private student loans and refinance your federal student loans together. With LendKey you can consolidate your loans into one convenient. SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers, or may become available, such as Income. How does student loan refinancing work? You can refinance both your federal student loans and your private student loans through a private lender, such as a. Refinancing lets you trade in your high-rate student debt for one low-rate loan with a single monthly payment. Student loan refinancing is when you take your loan(s) and go to a private lender to change the terms of your loan and/or lower your interest rate. Let's look at what it means to refinance private and federal student loans, what to consider, and how to start the refinancing process. Direct federal student loans should be refinanced as soon as you decide not to go for Public Service Loan Forgiveness (PSLF) and find an interest rate lower.

How Much Should You Spend On Groceries A Week

U.S. households spend an average of $ per week on groceries, or roughly $1, per month. Average weekly grocery spending is highest in California. Let's start with the million-dollar question: how much money should you spend on groceries? spend in a later week if you run into some irresistible sales. Now that I have more money, I range from $$70 a week, because its a comfortable amount that I can afford, be fed well, and not worry about it. How much money should we plan on Is $ enough spending + for food? We'll be there 6 days. Edit: 2. What does the average U.S. household spend on groceries per month? According to data from the Bureau of Labor Statistics, the average spending on food at. How Much Money to Spend on Grocery Shopping You're probably not surprised to know that the average family of 4 spends between $ and $ per month on food. That amount — about $ a month, or $ each week — represents nearly 12% of consumers' income. Your household size should determine how much you. Have a food budget. A rough rule of thumb is to allow about $ a week per person in your household, but the overall amount shouldn't be more than one-. How does what you spend on groceries compare to the estimate below? Remember To calculate overall household grocery costs we: Adjusted food costs. U.S. households spend an average of $ per week on groceries, or roughly $1, per month. Average weekly grocery spending is highest in California. Let's start with the million-dollar question: how much money should you spend on groceries? spend in a later week if you run into some irresistible sales. Now that I have more money, I range from $$70 a week, because its a comfortable amount that I can afford, be fed well, and not worry about it. How much money should we plan on Is $ enough spending + for food? We'll be there 6 days. Edit: 2. What does the average U.S. household spend on groceries per month? According to data from the Bureau of Labor Statistics, the average spending on food at. How Much Money to Spend on Grocery Shopping You're probably not surprised to know that the average family of 4 spends between $ and $ per month on food. That amount — about $ a month, or $ each week — represents nearly 12% of consumers' income. Your household size should determine how much you. Have a food budget. A rough rule of thumb is to allow about $ a week per person in your household, but the overall amount shouldn't be more than one-. How does what you spend on groceries compare to the estimate below? Remember To calculate overall household grocery costs we: Adjusted food costs.

How much should a single person spend on groceries? The average cost of food per month for one person is $ – $ and a realistic food budget for one ranges. I use coupons, but only save about $15 a week when using them. There are many people who spend significantly less than I do to feed as many people or more. I do. Two adults and one teenager. Average $ to $ This includes take out once a week. report. What do I do if there are no hotels available at per diem? Do I receive a meal reimbursement for day travel away from my regular duty station? How much per diem. It's up to you how much you want to spend on food per month, but the recommendation given by Dave Ramsey (I confirmed this with Paige Schmidt, a Dave Ramsey. Children get $ on a Summer EBT card for the summer to spend on approved groceries. How much will be loaded on the Summer EBT card? Each eligible. According to the Office for National Statistics' report on Family Spending, the average weekly spend on food and non-alcoholic drinks by a one adult. According to the U.S. Bureau of Labor Statistics, Americans devote between 11% and 15% of their budget to food each year. If you're sitting at the 15% mark. That's my large family grocery budget breakdown for our once-a-month grocery shopping day and the rest of the month. $ is spent on food in one day. $ A typical family of four (mother, father, and two young children) would spend about $ each week on groceries to meet the MyPlate recommendations. Families. Does any food go to waste at the end of the week? Write everything down and note how much you spend each week. Purge the non-essentials from your list. After. Quick Tips For Grocery Budgeting · 1. Determine Your Budget. The first step is to get a better understanding of how much you should spend on groceries per week. Moderate-cost plan. For a moderate budget for a family of four, you would spend $ a week for groceries or between $1, and $1, a month. Liberal. We have saved up for this purchase a couple of different ways. The first way is by setting aside $50/month out of our grocery budget. That adds up to $ a. Moderate-cost plan. For a moderate budget for a family of four, you would spend $ a week for groceries or between $1, and $1, a month. Liberal. So our grocery budget went back up. Right now, we budget $ for groceries for the two of us. That's $ per person per month. This seems like a good amount. Due to pay cuts and the poor economy I found myself needing to slash my family's grocery budget from about $$ a week, which I felt was fairly reasonable. What does the average U.S. household spend on groceries per month? According to data from the Bureau of Labor Statistics, the average spending on food at. A Snippet of Our Grocery Spending. Here's what a grocery list could look like from week to week: · Get Organized and Plan Accordingly · Take Your Time · Buy. You need to know how much money you can spend each week on groceries. It's easy to blow your budget at the grocery store, so you need to know how much cash you.

Why Havent I Received My Tax Return

If you still don't see it or it was mailed to you, you'll have to file Form with the IRS. If none of these apply, you'll have to call the. Why haven't I received my tax refund? If you filed a federal tax return, are owed a refund, and you owe past-due child support, the IRS may send your. Common reasons include changes to a tax return or a payment of past due federal or state debts. Tax return changes. If we made any changes to your tax return. For paper returns, please allow a minimum of three months to receive your refund if you file an error-free return. Your refund will generally be issued by July. If it has been more than 30 days and you have not received your refund check, you can start the refund check reissue process. tax return are valid and. I received a message that my refund information could not be found at this time. What should I do? · Wait 30 days if filed electronically · Wait 90 days if filed. If you filed electronically through a professional tax preparer and haven't received your refund check our online system. If not there, call your preparer. If you filed electronically through a professional tax preparer and haven't received your refund yet, contact your preparer first to make sure that your. You can start checking on the status of your refund within 24 hours after the IRS has received your e-filed return or 4 weeks after you mail a paper return. If you still don't see it or it was mailed to you, you'll have to file Form with the IRS. If none of these apply, you'll have to call the. Why haven't I received my tax refund? If you filed a federal tax return, are owed a refund, and you owe past-due child support, the IRS may send your. Common reasons include changes to a tax return or a payment of past due federal or state debts. Tax return changes. If we made any changes to your tax return. For paper returns, please allow a minimum of three months to receive your refund if you file an error-free return. Your refund will generally be issued by July. If it has been more than 30 days and you have not received your refund check, you can start the refund check reissue process. tax return are valid and. I received a message that my refund information could not be found at this time. What should I do? · Wait 30 days if filed electronically · Wait 90 days if filed. If you filed electronically through a professional tax preparer and haven't received your refund check our online system. If not there, call your preparer. If you filed electronically through a professional tax preparer and haven't received your refund yet, contact your preparer first to make sure that your. You can start checking on the status of your refund within 24 hours after the IRS has received your e-filed return or 4 weeks after you mail a paper return.

The Department may be waiting for information from your employer or the IRS for data verification. If we need additional information before issuing your refund. Yes. Call 1–TAX That's 1––– If you're willing to wait for a refund, then they'll be able to take a look into your account. Will the Where's My Refund tool tell you when you will receive your refund? Yes. When your refund is approved and processed, your status will update with an. These additional measures are implemented to protect your identity and ensure you receive the appropriate refund. If your return requires additional review, it. Frequently asked questions · Why haven't I received my tax refund yet? Most people receive their tax refund within 3 weeks of the IRS approving their tax return. Primary filer's Social Security number · Primary filer's last name · Tax year · Filing status · Adjusted Gross Income (AGI)/Total Household Resources (THR). If your. Several elements can affect the timing of your tax refund. Although ADOR works to send refunds as soon as possible, ADOR cautions taxpayers not to rely on. IRS identity theft filters sometimes delay returns and tax refunds until taxpayers verify their identities. If this happens, you'll usually receive IRS Letter. Generally, your State income tax refund must be included in your federal income for the year in which your check was received if you deducted the State income. How long will it take for me to receive my refund? OTR's enhanced security measures to safeguard tax dollars and combat identify theft/tax refund fraud may. Twenty-four hours after we have received your electronically filed tax return or 4 weeks after you have mailed a paper tax return. Will Where's My. Try calling.. I filed at the beginning of Feb.. Called a month ago and was told to call back in a month if I didn't receive my refund or a. If you received a refund amount different from the amount on your tax return, we'll mail you a letter explaining the difference. Wait for that letter or view. After submitting your return, please allow at least weeks of processing time before checking your refund status. If you have not received your refund within weeks of filing, then your refund may have been stopped for review. Use Where's My Refund to check the status of individual income tax returns and amended individual income tax returns you've filed within the last year. How long will it take to get your refund? · Electronically filed returns: Up to 4 weeks · Paper filed returns: Up to 8 weeks · Returns sent by certified mail. Our strong fraud and error safeguards could delay some returns, both e-filed and paper, up to 12 weeks. If I filed electronically but did not receive my refund. If your refund amount is different than what is shown on your return, you will receive a notice within 7 to 10 business days explaining the difference. How long. What should I do, I lost my refund check or I never received by refund?

Usaa Home Insurance Price

Extremely small price to pay in hindsight. USAA auto insurance has been top notch for me as well compared to Geico and AllState claims in the. The average rate from USAA is $1, per year for $, of dwelling coverage. Erie and USAA have the best home insurance in West Virginia, based on a. Discover the types of property insurance and coverage options USAA offers, plus ways you can save with property insurance discounts. Get a quote today. Shifts in economic conditions, coupled with evolving risk landscapes, often exert pressure on insurance premiums. Risk Assessment: Balancing. What is the average monthly cost for homeowner's insurance? The average homeowners insurance premium in the U.S. costs $1, annually or roughly $85 per month. USAA's average homeowners insurance rate is around $ per month, while Learn more about the factors insurers use to price your home insurance quote. USAA's average annual home insurance rate of $1, for dwelling coverage of $, is well below the national average. It earns a spot on our rating of the. Your rate could go up because of construction costs, building code changes or home improvements that could increase your rebuild cost. It's important to make. Get the home insurance coverage you need. Learn about the different homeowners policy options offered by USAA. Extremely small price to pay in hindsight. USAA auto insurance has been top notch for me as well compared to Geico and AllState claims in the. The average rate from USAA is $1, per year for $, of dwelling coverage. Erie and USAA have the best home insurance in West Virginia, based on a. Discover the types of property insurance and coverage options USAA offers, plus ways you can save with property insurance discounts. Get a quote today. Shifts in economic conditions, coupled with evolving risk landscapes, often exert pressure on insurance premiums. Risk Assessment: Balancing. What is the average monthly cost for homeowner's insurance? The average homeowners insurance premium in the U.S. costs $1, annually or roughly $85 per month. USAA's average homeowners insurance rate is around $ per month, while Learn more about the factors insurers use to price your home insurance quote. USAA's average annual home insurance rate of $1, for dwelling coverage of $, is well below the national average. It earns a spot on our rating of the. Your rate could go up because of construction costs, building code changes or home improvements that could increase your rebuild cost. It's important to make. Get the home insurance coverage you need. Learn about the different homeowners policy options offered by USAA.

Protect your mobile home from fire, windstorms and vandalism with an insurance plan from USAA. Get a quote today. USAA is known for its exceptional customer service and competitive rates for military members and families, averaging around $1, per year. This insurer. Progressive offers some of the cheapest home insurance rates in our analysis, costing an average of $ per year for a home insurance policy with $, in. We found that the average year-old married driver with good credit and a clean driving record pays $1, per year or $88 per month for full-coverage car. Save up to 10% on your homeowners premium if you have an auto insurance policy with USAA. Learn more about our auto and home combination discount. At Liberty Mutual, you can customize your coverages to get the best homeowners insurance for your home at an affordable price. Start your home insurance quote. USAA vs. State Farm: home insurance rate comparison USAA's average homeowners insurance rate is $ per month. The average rates for State Farm are slightly. While specific figures can differ, as of , the average annual cost of a USAA homeowners insurance policy can range between $ to $ per year. However. The result could be higher homeowners insurance premiums for an older home versus a comparable new one. Copyright © The USAA Educational Foundation. USAA's home insurance covers the actual cash value of your home and belongings, meaning you'll get enough money to buy a replacement for anything damaged by a. USAA offers competitive rates, award-winning service and a variety of discounts on auto, homeowners, life, property insurance and more. Get a quote today. The average cost of homeowners insurance in the U.S. is $2, per year for $, in dwelling coverage. However, your actual rates may vary depending on. The USAA insurance quote on vehicles in Texas reached an average monthly price of $ in Is USAA Insurance Expensive? The USAA full-coverage cost is. You can get a valuable personal property policy from USAA for as little as $2 a month. Plus, you don't need to have another USAA policy to get it! That sounds. Your renters policy automatically covers family members who live with you, including your spouse and children. Roommates need to buy their own renters insurance. USAA offers competitive rates, award-winning service and a variety of discounts on auto, homeowners, life, property insurance and more. Get a quote today. With USAA, a policy with $K in dwelling coverage costs an average of $4, per year, much lower than a Travelers policy, which costs $5, However. Rates · Licensing · Insurers · Captive Insurers · Self-Insured · News & Notices (USAA) – Market Share: %. Garrison Property & Casualty Insurance. USAA has been jacking up all of their rates for years. And they get away with it because a lot of people have blind loyalty to them. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to.

Average Price For Rolex

The average cost of an Air-King ref. on Bob's Watches is about $6,, with the least expensive watch coming in at just under $5, One outlier in our. The average cost of Rolex Watches is $18, How to choose When choosing Rolex Watches, you should pay attention to the following. The average price for most Rolex watches falls between $7, – $12, MSRP. GMT-Master II. Join the ranks of excellence with authentic men's & women's Rolex watches. Try on the Submariner, Oyster Perpetual, Datejust & more in our boutique store. How Much Is A Rolex Watch? Rolex watches come with a wide price range, starting at $5, and soaring up to $75, MSRP, offering options for various budgets. With every consumer item there is compromise. Whether it's cost, size, practicality or comfort. For many, that compromise is worth the sacrifice, for others, it. how much on average would you need to make to afford the watch? I earn probably less than % of normal Rolex wearers and I have. Rolex does an annual 7% price hike. In two year's time, you'll pay approximately $11, for the watch. So, in reality, you're paying $ for the benefit. How much does a Rolex cost? In spring , Rolex was listing the models in their portfolio for between 6, and 41, USD. But there's a catch: It's. The average cost of an Air-King ref. on Bob's Watches is about $6,, with the least expensive watch coming in at just under $5, One outlier in our. The average cost of Rolex Watches is $18, How to choose When choosing Rolex Watches, you should pay attention to the following. The average price for most Rolex watches falls between $7, – $12, MSRP. GMT-Master II. Join the ranks of excellence with authentic men's & women's Rolex watches. Try on the Submariner, Oyster Perpetual, Datejust & more in our boutique store. How Much Is A Rolex Watch? Rolex watches come with a wide price range, starting at $5, and soaring up to $75, MSRP, offering options for various budgets. With every consumer item there is compromise. Whether it's cost, size, practicality or comfort. For many, that compromise is worth the sacrifice, for others, it. how much on average would you need to make to afford the watch? I earn probably less than % of normal Rolex wearers and I have. Rolex does an annual 7% price hike. In two year's time, you'll pay approximately $11, for the watch. So, in reality, you're paying $ for the benefit. How much does a Rolex cost? In spring , Rolex was listing the models in their portfolio for between 6, and 41, USD. But there's a catch: It's.

Rolex Watches · Shop Pre-Owned Rolex Models: · Air King · Bubbleback · Cellini · Datejust · Datejust II · Day Date · Daytona. Rolex models, depreciate compared to their original retail price. This is Our healthy financial standing enables us to maintain a competitive cost structure. Prices have increased by % over 3 years and a substantial % over the past 5 years, reaffirming the investment potential of Rolex watches. Prices have increased by % over 3 years and a substantial % over the past 5 years, reaffirming the investment potential of Rolex watches. Rolex Submariner LN Price. $13, · -$ ; Rolex Submariner LV Price. $14, · -$1, ; Rolex Submariner Price. $12, · -$ ; Rolex. Rolex is a Swiss watch brand founded in Rolex watches cost around $12, on average, though prices range from around $2, to $, depending on. Rolex Cosmograph Daytona Price Range In steel: despite being listed on the Rolex website at £11,, you won't be paying that. Chisholm Hunter has the most. The cost of a Rolex in our collection goes from USD $4, to USD $, depending on the model and condition of the timepiece. Shop online with free. This watch was priced at $27, ($30, with inflation). This was also the year that the white gold Rolex President Day-Date was introduced at a price. Rolex ; Datejust Yellow Gold & Steel Black Dial 41mm · US$ 16, ; Datejust 41 Steel Jubilee Grey Dial · US$ 15, ; Lady-Datejust Rose Gold & Steel Brown Dial. Usually 50 bucks for a BJ and for the full package. Nice watch by the way. shows the average market price (in USD) of these 30 watches over time, and is rebalanced once per year on January 1. Rolex is the most recognized watch name on the planet and is best known for its Oyster Perpetual, the Cosmograph Daytona, and the Sea and Sky-Dweller. Our Selection ; Rolex Certified Pre-Owned. Datejust. , 26 mm, yellow gold. $20, ; Rolex Certified Pre-Owned. Explorer. , 39 mm, stainless steel. Case Size. 24mm26mm28mm29mm31mm34mm35mm36mm ; Price. $2, - $6,$6, - $12,$12, - $24,$24, and more ; Gender. Men'sWomen's ; Dial Color. Black. Rolex watches are crafted from the finest raw materials and assembled with scrupulous attention to detail. Discover the Rolex collection on apc-top.ru How much are Rolex watches? Some Rolex models are worth more than others because of certain factors like materials, movements, popularity, complications, and. According to list prices, most models cost between 5, and 35, euros: a Rolex Oyster Perpetual 31 costs around 5, euros, while the cost of a Rolex Day-. How often do I need to service a Rolex? · Where can I have my Rolex serviced? · What does a Rolex servicing consist of? · How much does servicing a Rolex cost? How Much Does a Rolex Cost? When you are trying to purchase a Rolex, you must start with the cost. Entry-level models of these watches will cost you between.

A Good Student Credit Card

Explore student credit cards ; NEW CARD MEMBER OFFER ; Earn a one-time $50 cash bonus once you spend $ on purchases within 3 months from account opening. Student Credit Card Comparison ; Annual Fee, $0, $0 ; Interest on Purchases, % – %, 0% ; Instant approval? ✓, ✓ ; Credit or Pre Paid, both, pre paid. From travel and cash rewards to a lower interest rate, we have credit cards for students with a variety of features. Learn more with our comparison tool. Consider annual fees. See if the extra perks outweigh the cost of the annual fee. ; Look for 3-bureau reporting. Build your credit with a card that reports to. Most student credit cards have no credit history requirement, no minimum income requirement, and no annual fee. And getting a student credit card can be your. Student credit cards are a great way for young people to establish a credit history Card Art Mastercard® Black Card™. **Recommended Credit. Excellent-Good. The best credit cards for high school or college students typically offer cash back, rewards and other perks like low interest rates. Student credit cards are a great way for young people to establish a credit history Card Art Mastercard® Black Card™. **Recommended Credit. Excellent-Good. Discover student credit cards let you earn cash back rewards and build a credit history 5 while you're in college. No annual fee. No credit score required to. Explore student credit cards ; NEW CARD MEMBER OFFER ; Earn a one-time $50 cash bonus once you spend $ on purchases within 3 months from account opening. Student Credit Card Comparison ; Annual Fee, $0, $0 ; Interest on Purchases, % – %, 0% ; Instant approval? ✓, ✓ ; Credit or Pre Paid, both, pre paid. From travel and cash rewards to a lower interest rate, we have credit cards for students with a variety of features. Learn more with our comparison tool. Consider annual fees. See if the extra perks outweigh the cost of the annual fee. ; Look for 3-bureau reporting. Build your credit with a card that reports to. Most student credit cards have no credit history requirement, no minimum income requirement, and no annual fee. And getting a student credit card can be your. Student credit cards are a great way for young people to establish a credit history Card Art Mastercard® Black Card™. **Recommended Credit. Excellent-Good. The best credit cards for high school or college students typically offer cash back, rewards and other perks like low interest rates. Student credit cards are a great way for young people to establish a credit history Card Art Mastercard® Black Card™. **Recommended Credit. Excellent-Good. Discover student credit cards let you earn cash back rewards and build a credit history 5 while you're in college. No annual fee. No credit score required to.

With a Bank of America® Customized Cash Rewards credit card for students you earn 3% cash back in the category of your choice: gas & EV charging stations. There's a credit card for everyone at USC Credit Union, including the Student Platinum Rewards Mastercard, a low-rate student credit card designed to help. They're powerful tools for establishing credit, allowing students to learn responsible credit card use, improve their credit score for the future, AND earn. Is a student credit card right for you? Student credit cards often have lower credit limits and higher interest rates. So, they may not be the best option if. Start your financial journey with these picks for college student credit cards. Find the right card and start building credit. The Neo Mastercard is a top no-annual-fee credit card for earning cash back rewards. This card does not have a minimum income threshold and only. A credit card can be a valuable addition to anyone's wallet, including college students. Not only does it provide flexibility when making purchases; it also. 1. Chase Freedom Student Credit Card In addition to offering a cash back rewards program, the Chase Freedom Student credit card comes with a $50 bonus when. NerdWallet named SavorOne Rewards for Students the best student card of because it has bonus categories and no annual fee or rewards caps, and it reports. The Discover it Student cash back card is a credit card that lets college students earn cash back on every purchase. The Petal® 2 "Cash Back, No Fees" Visa® Credit Card is ideal for college students because it's easy to get approved for and you won't have to worry about fees. Our Platinum Mastercard is not only a great fit for those looking for a low-interest rate, it's the perfect credit card for students. First Latitude Select Mastercard® Secured Credit Card · Earn 1% Cash Back Rewards on payments made to your First Latitude Secured credit card account. · Past. A secured credit card uses cash assets, like your bank account, as collateral, making it easier to qualify for. While traditional credit cards have strict rules. Student credit cards can help you establish a credit history, reduce fraud when making purchases, and track your spending. When shopping for or using a student. A student credit card is a type of credit card designed and marketed towards students and recent graduates by banks and financial institutions. Student credit. A 0% APR credit card will allow you to make purchases without accruing interest, helping you save money in the long run. However, it is important to note that. Complete with all the convenience and purchasing power of a traditional credit card, we've created a credit program just for you that also offers a dose of. PNC Cash Rewards® Visa® Credit Card · You'll receive a $ Bonus after you make $1, or more in purchases during the first 3 months following account opening. Visa Credit Cards · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Self - Credit Builder Account with Secured Visa® Credit Card · Wells Fargo Reflect®.